Intrinsic Value of Options Definition, Calculation, Formula

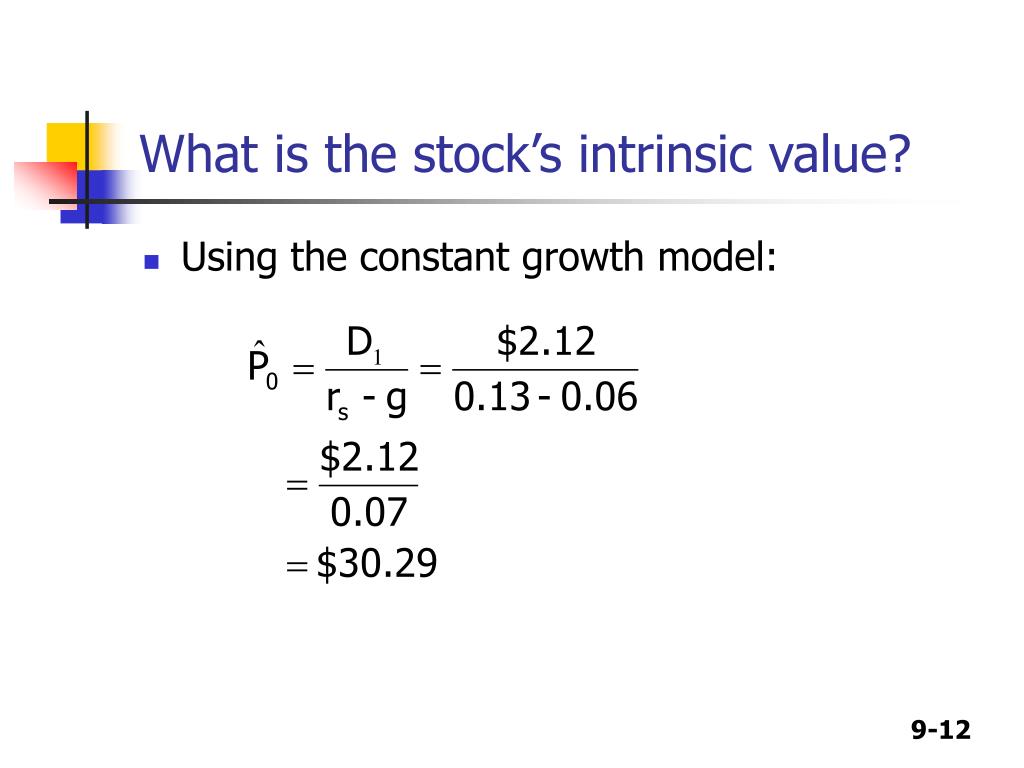

Here's the formula for this approach using the P/E ratio of a stock: Intrinsic value = Earnings per share (EPS) x (1 + r) x P/E ratio. where r = the expected earnings growth rate. Let's say that.

Intrinsic Value Definition and Calculation Option Alpha

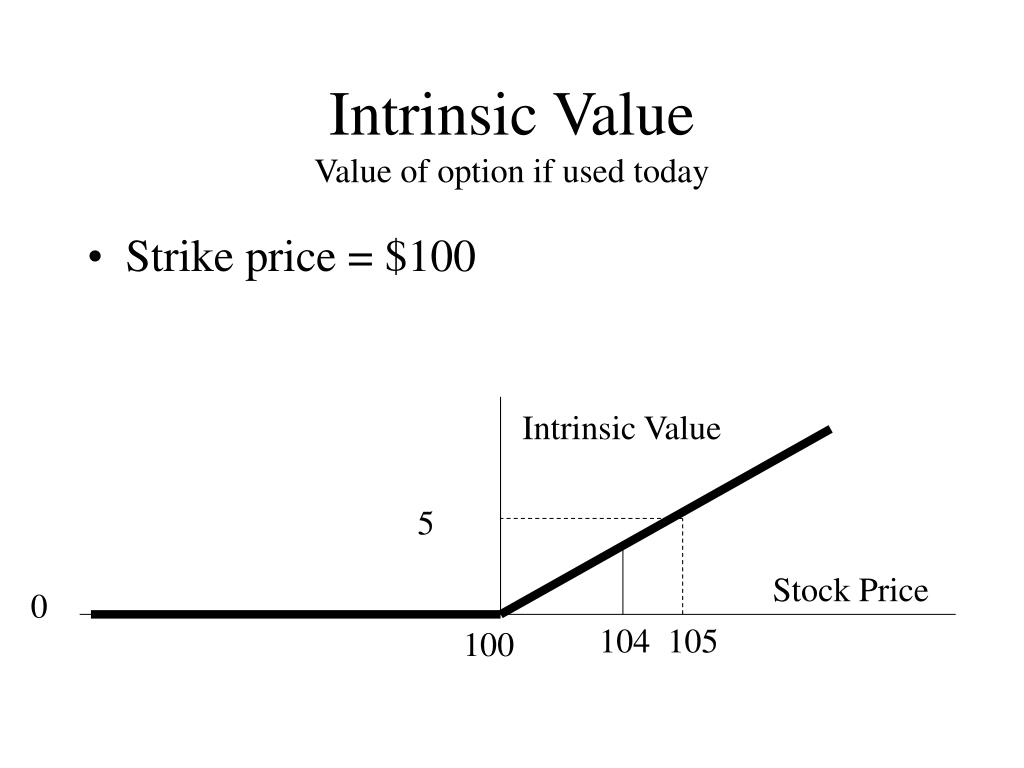

Intrinsic value is the amount of money an option is in-the-money (ITM). Simply subtract the strike price from the underlying asset's current market price to calculate intrinsic value. For example, a call option with a $50 strike price has $5 of intrinsic value if the stock price is $55. The same calculation applies to put options.

Real options valuation examples designersholoser

Intrinsic value formula for a put option: Put Option Intrinsic Value = Put Strike Price - Underlying Stock's Current Price. Example of Intrinsic Value Calculation. Imagine that hypothetical XYZ stock is selling at $48.00. A call option for XYZ with a strike price of $40 would have an intrinsic value of $8.00 ($48 - $40 = $8).

Intrinsic value stock option method and with it make money adwords clickbank

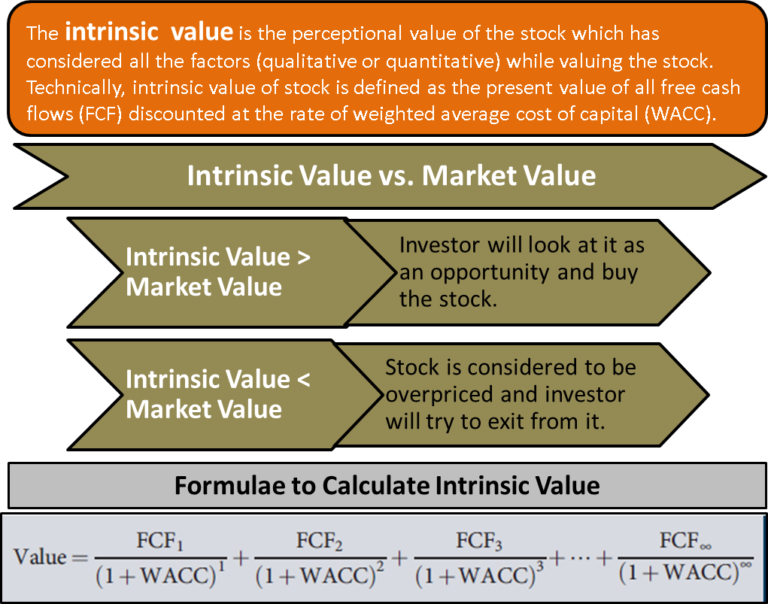

Intrinsic value formula = Value of the company / No. of outstanding shares. = $2,504.34 Mn / 60 Mn. = $41.74. Therefore, the stock is trading below its fair value, and as such, it is advisable to purchase the stock at present as it is likely to increase in the future to attain the fair value.

intrinsic value and time value of options ।। time value in option how to calculate YouTube

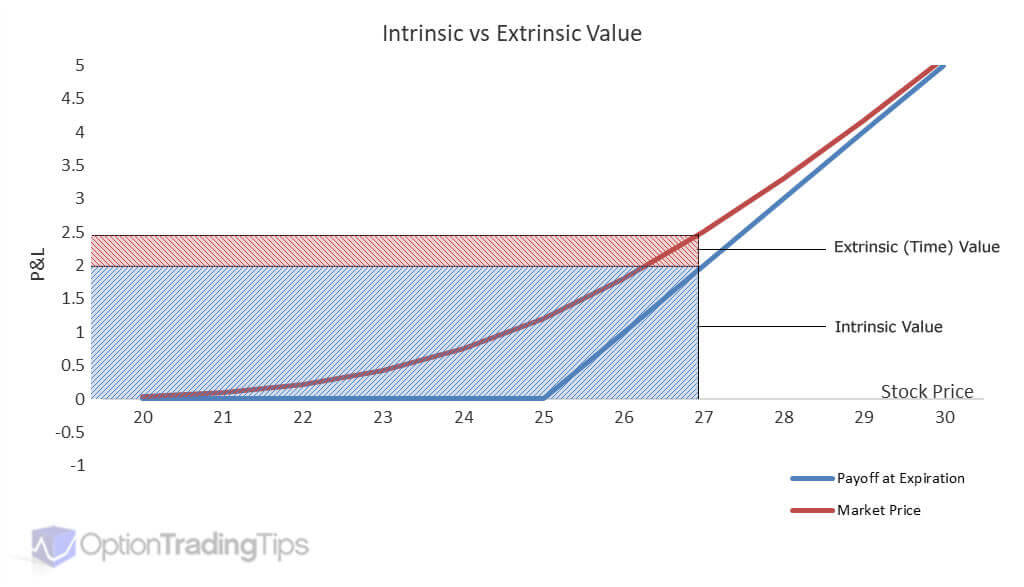

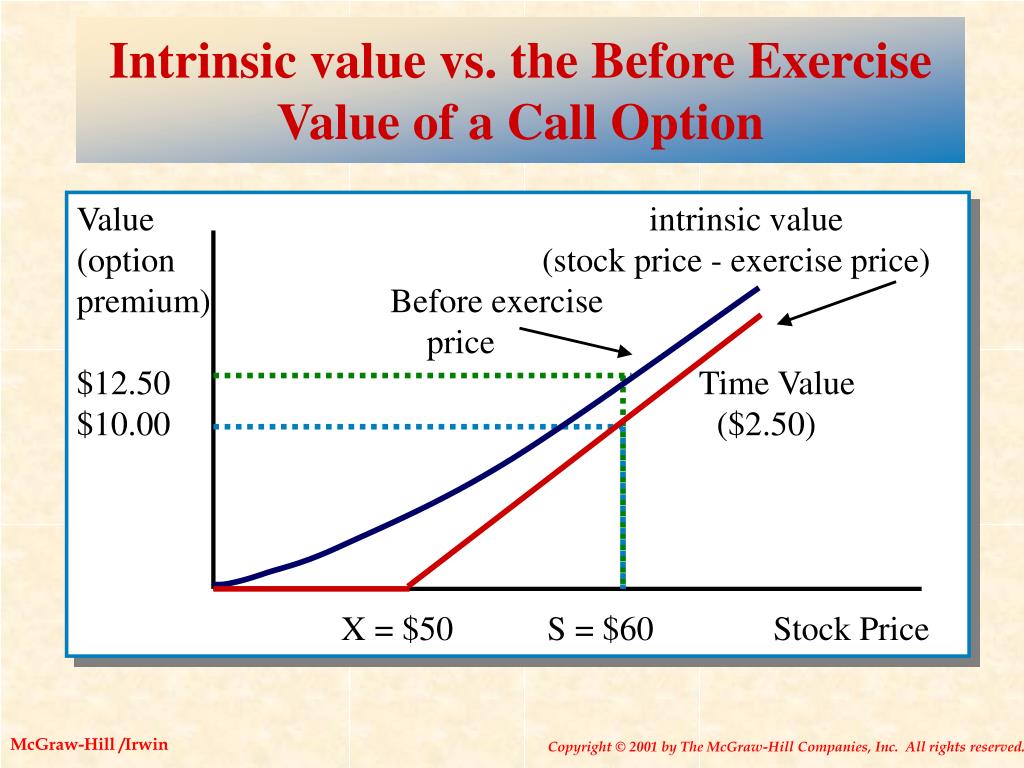

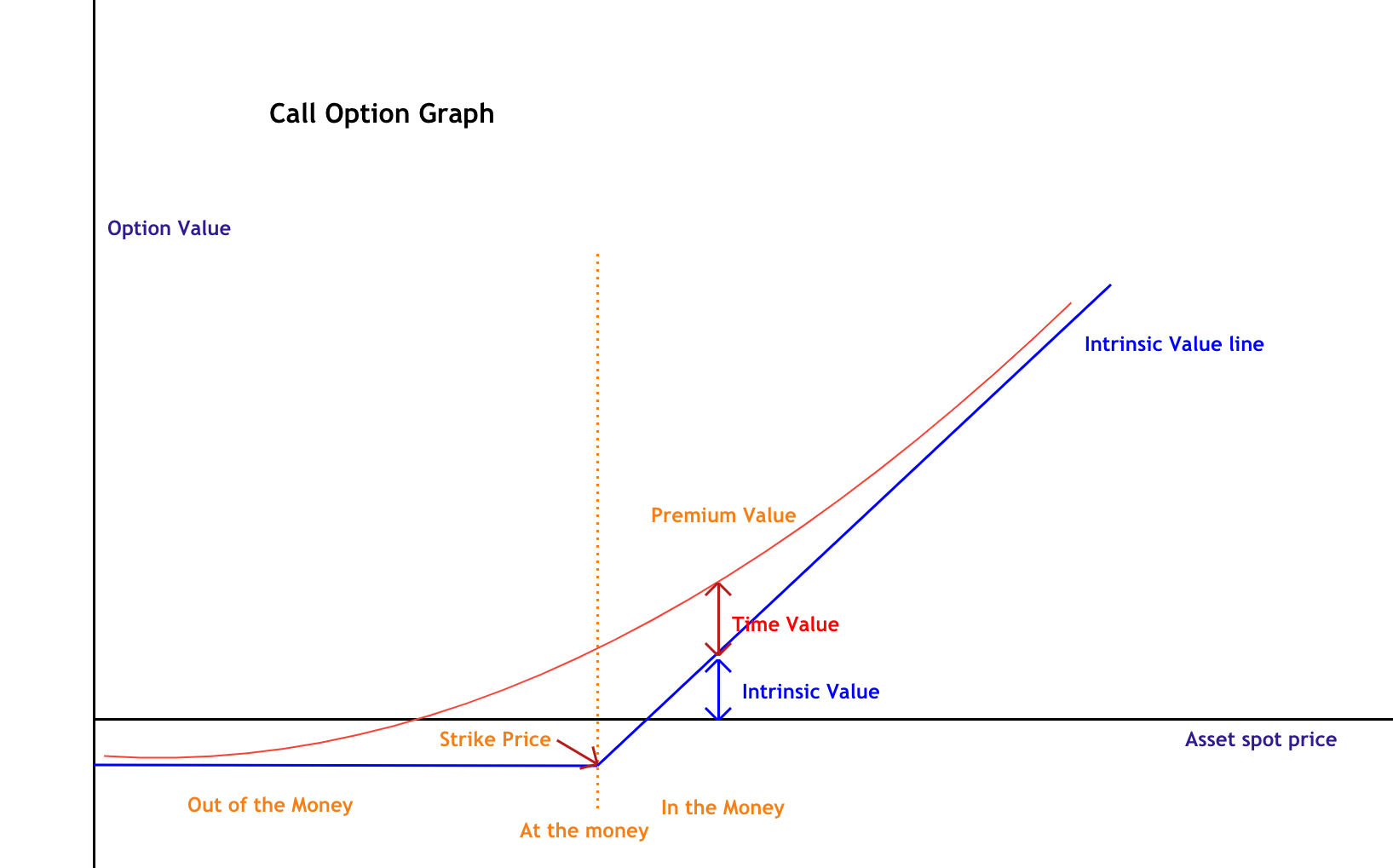

Premium components. This price can be split into two components: intrinsic value, and time value (also called "extrinsic value"). Intrinsic value. The intrinsic value is the difference between the underlying spot price and the strike price, to the extent that this is in favor of the option holder. For a call option, the option is in-the-money if the underlying spot price is higher than the.

PPT Options PowerPoint Presentation, free download ID465766

Thus, the formula for the intrinsic value of the put option is: = Strike Price - Spot Price. To understand this, let's consider an example where a trader buys a put option of Nifty 18000. Now let's consider different scenarios to understand intrinsic value in put option: 1. Nifty expires at 17800.

PPT Chapter Ten PowerPoint Presentation, free download ID6890987

If the market price is above the strike price, then the put option has zero intrinsic value. Look at the formula below. Put Options: Intrinsic value = Call Strike Price - Underlying Stock's Current Price. Time Value = Put Premium - Intrinsic Value. The put option payoff will be a mirror image of the call option payoff.

Intrinsic Value What is the intrinsic value? Estradinglife

The strike price determines whether an option has intrinsic value. An option's premium (intrinsic value plus time value) generally increases as the option becomes further in-the-money. It decreases as the option becomes more deeply out-of-the-money. Time until expiration, as discussed above, affects the time value component of an option's premium.

How To Calculate The Intrinsic / Extrinsic Value of an Option In Your Spreadsheet · Market Data

The first case we can find on our options screener has a strike price of $170, and its bid-ask prices are quoted at $16.60-$17.20. To calculate the intrinsic value, we subtract the strike price from the stock price: $180.74 - $170 = $10.74. This is the option's intrinsic value.

PPT Introduction to Financial Derivatives PowerPoint Presentation ID6537335

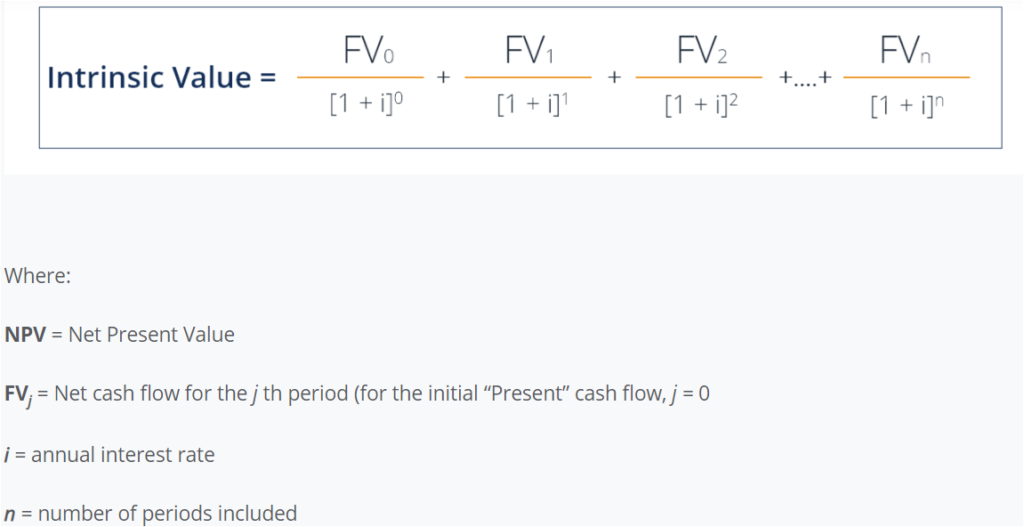

Intrinsic Value Formula. There are different variations of the intrinsic value formula, but the most "standard" approach is similar to the net present value formula. Where: NPV = Net Present Value. FVj = Net cash flow for the j th period (for the initial "Present" cash flow, j = 0. i = annual interest rate. n = number of periods included.

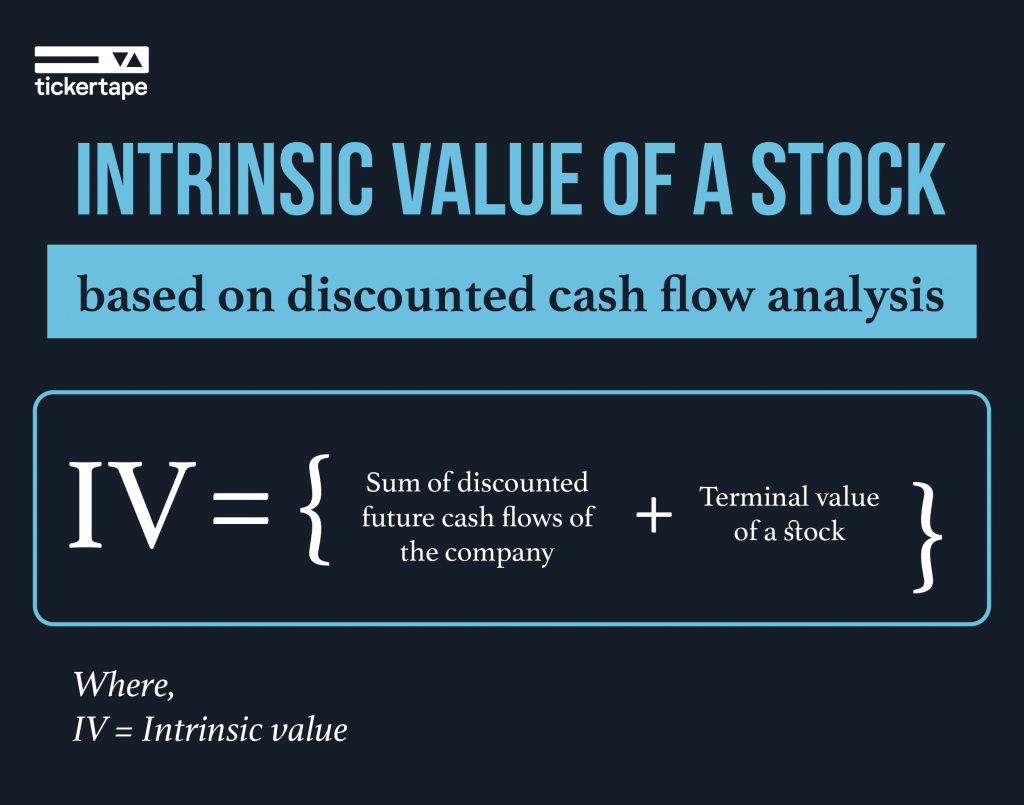

What Is the Intrinsic Value of a Stock and How To Calculate It? Blog by Tickertape

Hence to answer the above question, we need to calculate the intrinsic value of an option, for which we need to pull up the call option intrinsic value formula from Chapter 3. Here is the formula - Intrinsic Value of a Call option = Spot Price - Strike Price. Let us plug in the values = 8070 - 8050 = 20

How to Calculate Time Value, Intrinsic Value & Premium of an Option ? YouTube

Option valuation is both intrinsic value and time value. The time value, which is the opportunity cost of an early exercise of an option, is not always intuitive or accounted for.. The payoff (not profit) at maturity can be modeled using the following call option formula and plotted in a chart. Excel formula for a Call: = MAX (0, Share Price.

Intrinsic Value Define, Calculate, Formula, Market Value, Book Value

For call options: If the market price of the underlying asset surpasses the option's strike price, the intrinsic value is defined as the numerical difference between these two figures. As an.

Forex Options 2 Intrinsic Value & Time Value Forex Academy

Moneyness: A description of a derivative relating its strike price to the price of its underlying asset . Moneyness describes the intrinsic value of an option in its current state.

What is Intrinsic Value? Definition + Examples

Intrinsic value is the relationship between the strike price and the market level of the underlying assets. The deeper in the money (ITM) the option is, the higher the premium will be. Time value is the period until the option's expiration date. The further away the expiration, and the higher the volatility of the asset, the higher the premium.

The 7 Factors That Determine Option Pricing And Value

Option Value = Intrinsic Value + Time Value. When an option contract expires, the time value would be zero. At this point the option value is equal to the intrinsic value. Option Value = Intrinsic Value + 0. Let's look at an example when the option has time value greater than zero. Suppose a call option will expire in one month.

.